Below are the latest State tax tables which are integrated into the United States Tax and Salary Calculators on iCalculator. Fileid: -TAX TABLE/2020/A/XML/Cycle01/source. State Tax Tables are updated annually by the each States Tax Administration Office. Standard Deduction 22,000 PAYE TAX TABLES MONTHLY MONTHLY PAYE TABLES P2000 2005 - 2175 2180 - 2350 2355 - 2525 Salary Tax Salary Tax Salary Tax Salary Tax 1,830 0.00 2,005 17.17 2,180 34.67 2,355 62. You can also find supporting links to the State Tax tables for each State linked from the Federal Tax Tables or select the current year State Tax Tables from the State list further down this page.

Federal Tax Tablesīelow are the tax tables which are integrated into the United States Tax and Salary Calculators on iCalculator.

#2020 TAX TABLES PDF FREE#

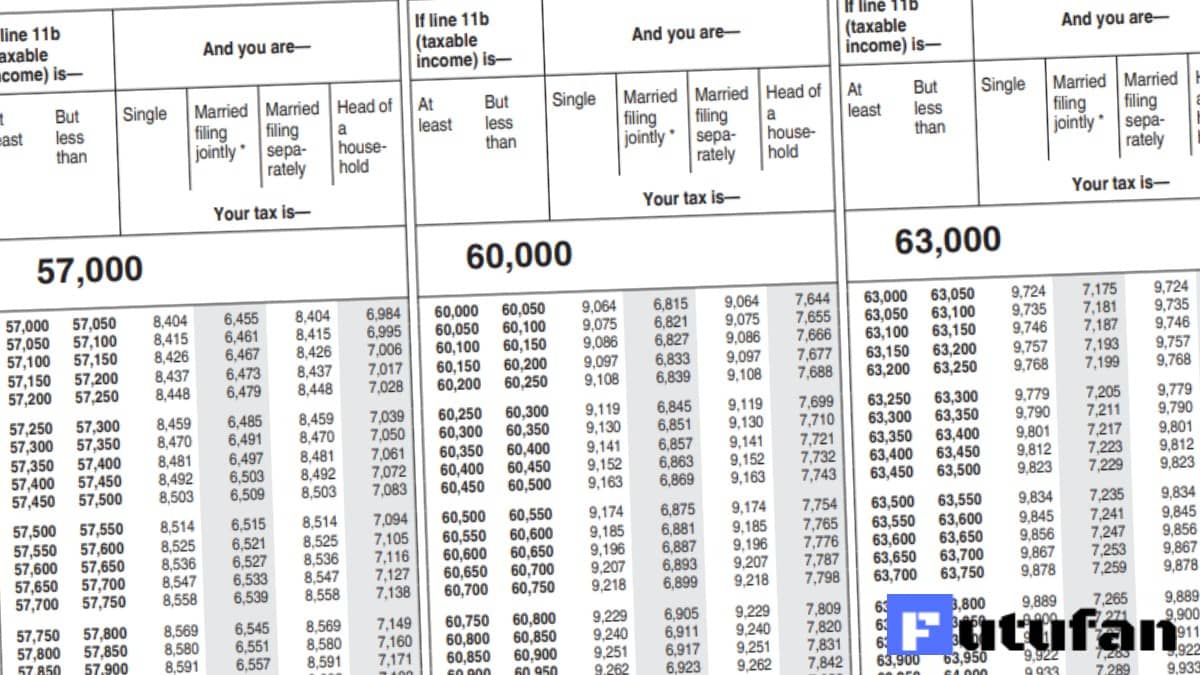

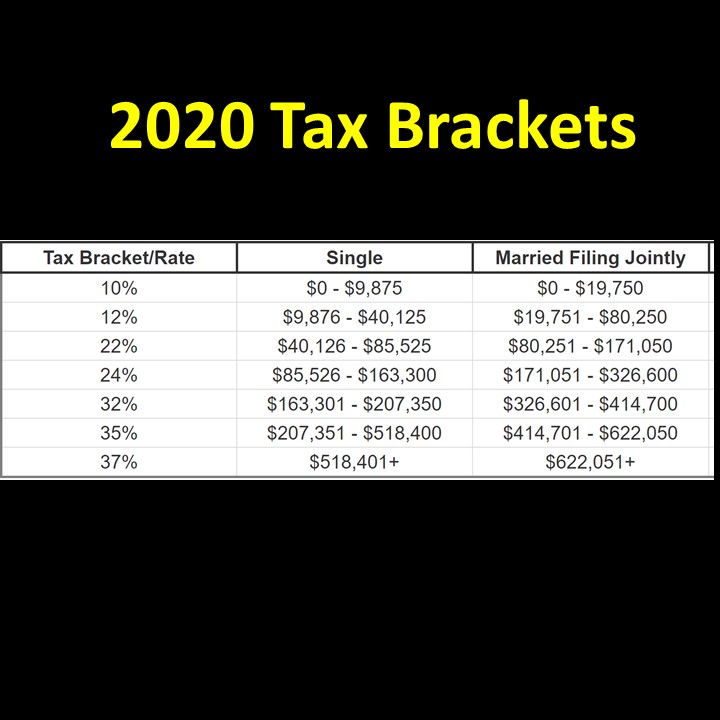

You may also be interested in using our free online 2020 Tax Calculator which automatically calculates your Federal and State Tax Return for 2020 using the 2020 Tax Tables (2020 Federal income tax rates and 2020 State tax tables). Then Taxable Rate within that threshold is:Ģ020 Federal Income Tax Rates: Married Individuals Filling Joint Returns If Taxable Income is:Ģ020 Federal Income Tax Rates: Married Individuals Filling Seperately If Taxable Income is:Ģ020 Federal Income Tax Rates: Head of Household If Taxable Income is:Ģ020 Federal Income Tax Rates: Widowers and Surviving Spouses If Taxable Income is: 2020 Federal Income Tax Rates: Single Individuals If Taxable Income is: The Income Tax Rates and Thresholds used depends on the filing status used when completing an annual tax return. You will also find supporting links to Federal and State tax calculators and additional useful information to assist with calculating your tax return in 2020 2020 Federal Income Tax Rates and Thresholdsįederal Income Tax Rates and Thresholds are used to calculate the amount of Federal Income Tax due each year based on annual income. This page provides detail of the Federal Tax Tables for 2020, has links to historic Federal Tax Tables which are used within the 2020 Federal Tax Calculator and has supporting links to each set of state tax tables for 2020. Sample W2 Template (Excel File) using the Accepted Electronic W-2 Formats listed in the document above.The Internal Revenue Service (IRS) is responsible for publishing the latest Tax Tables each year, rates are typically published in 4 th quarter of the year proceeding the new tax year. 2022 EL-1120 Instructions: Corporation Return Instructions (PDF)Įmployer Withholding After submitting their completed EL-SS-4, employers can use the City of East Lansing's new Employer Withholding Tool to set up their withholding tax account and complete their withholding tax reporting and payment.2022 EL-1120 Return: Corporation Return (PDF) The Alabama State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Alabama State Tax Calculator.We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.EL-6-IT Notice of Change or Discontinuance.2022 EL-1065 Instructions: Partnership Return Instructions (PDF).

2022 EL-1041 Return - Trust Return (PDF).

#2020 TAX TABLES PDF PDF#

All other PDF forms can be enlarged by zooming in.** Trusts **Forms for people with low vision/partially sighted people are available by calling (517) 319-6862 or emailing the income tax office.

EL- 1040X Amended Income Tax Return (PDF) Enter the result here and on the entry space on line 16.EL-1040X Instructions for Amended Individual Income Tax Return (PDF).EL-2848 Power of Attorney Authorization (PDF).2022 Part Year Resident Calculation (PDF).2022 EL-1040 Individual Return Attachments pages 3-15 (PDF).2022 EL-1040 Individual Return pages 1-2 (PDF).

0 kommentar(er)

0 kommentar(er)